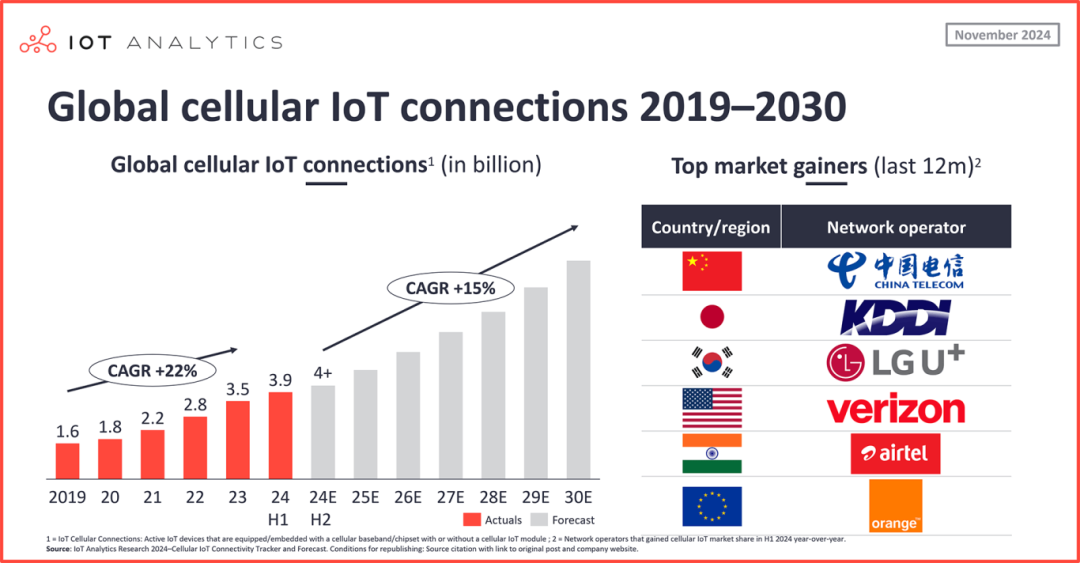

With the continuous advancement of IoT technology and the expansion of application areas, the global cellular IoT market is experiencing unprecedented growth. At the end of 2024, this market reached an important milestone: the latest report from research firm IoT Analytics shows that the number of global cellular IoT connections has exceeded the 4 billion mark, accounting for about 22% of the total number of global IoT connections.

IoT Analytics said that global cellular IoT connections reached 3.9 billion in the first half of 2024, a year-on-year increase of 20% and a growth of 181% in the past five years. After continuous analysis, it was found that by the end of the third quarter of 2024, the number of cellular IoT connections will exceed 4 billion, and it is expected to reach 4.2 billion by the beginning of 2025. Driven by LTE Cat 1 bis and 5G, the number of connections between 2024 and 2030 is expected to climb at a compound annual growth rate (CAGR) of 15%.

Image source: IoT Analytics

LTE Cat 1 bis to boost cellular IoT growth

LTE Cat 1 bis has made a significant contribution to the growth of cellular IoT, with its number of connections increasing by 68% year-on-year in the first half of 2024. Based on 3GPP Release 13, LTE Cat 1 bis adopts a single antenna design optimized for low-power applications, reducing hardware complexity and cost, making it more attractive to manufacturers and solution providers.

In terms of market demand, due to the lack of LTE-M and the limitations of NB-IoT, China has accelerated the adoption of LTE Cat 1 bis. The latest data from IoT Analytics shows that China accounts for 85% of global LTE Cat 1 bis connections and achieved 56% year-on-year growth in the first half of 2024.

In terms of performance, LTE Cat 1 bis provides high-speed capabilities of up to 10 Mbps downlink and 5 Mbps uplink while maintaining low power consumption. LTE Cat-1bis was introduced in 3GPP Release 13, so two energy-saving features, PSM (Power Saving Mode) and eDRX (Extended Discontinuous Reception), were also introduced to better adapt to power-constrained applications.

Although not as energy-efficient as NB-IoT or Cat-M, Cat-1-bis still achieves a good balance between power consumption and throughput, and is particularly useful for devices that require frequent communication while maintaining battery life, such as smart meters and fleet management. , medical devices and payment solutions.

From a cost-effective perspective, LTE Cat 1 bis operates on existing LTE networks around the world, providing broad coverage. Ericsson data shows that LTE networks will cover 85% of the world's population except China in 2023. It provides a seamless migration path as 2G and 3G networks are retired, ensuring long-term and continued support for IoT applications.

In addition, the cost of Cat-1bis has also dropped quite rapidly, which has triggered a wave of customers migrating from LPWA or Cat-1 to Cat-1bis. Counterpoint research points out that Cat-1bis average selling price (ASP) will almost halve by 2024, making it a more cost-effective alternative in cost-constrained applications. At the same time, Aojie Technology doubled its global market share in the second quarter of 2024 with the strong performance of its chipsets in the Cat-1bis field.

The development driving force of 5G IoT: FWA and automobiles

Thanks to the iterations of 3GPP Release 15 and subsequent versions, 5G IoT connections have also achieved significant growth, enhancing their characteristics for high-speed (up to 20Gbps) and low-latency (as low as 1 millisecond) applications, which is ideal for applications that require Immediate response and high throughput applications are critical. 5G is capable of supporting up to one million devices per square kilometer, meeting the growing number of IoT devices.

Looking at market demand, China's massive investment in 5G infrastructure has created a strong ecosystem that supports widespread adoption. The availability of 5G-compatible devices and modules has lowered the threshold for various industries to implement 5G IoT solutions. IoT Analytics tracking analysis shows that China accounts for approximately 80% of global 5G IoT connections, with a year-on-year growth of 79% in the first half of 2024.

In terms of applications, FWA and the automotive industry are driving the growth of 5G IoT.

In the first half of 2024, FWA used 5G networks to provide high-speed Internet access to homes and businesses, especially in areas lacking fiber optic infrastructure, contributing 45% of global 5G IoT connections. This approach provides a cost-effective alternative to traditional broadband services and expands connectivity in less developed areas, a boon for long-range IoT connectivity needs.

Meanwhile, the latest research from the Global Mobile Suppliers Association (GSA) predicts that 5G will account for 42% of all FWA client device shipments this year, up from 34% last year, indicating that 5G will become the main FWACPR technology next year. John Yazlle, vice chairman of the GSA 4G/5G FWA Forum, said that this market dynamic "undoubtedly proves that 5G FWA has become mainstream."

The Internet of Vehicles is one of the important downstream industries of 5G. 5G helps the automotive industry move towards intelligent transformation. Data shows that the automotive industry, including transportation, supply chain and logistics, accounted for 26% of global 5G IoT connections during the same period, and the industry is integrating 5G IoT to enhance real-time navigation, telematics and infotainment.

In addition, 5G supports future technologies such as Cellular Vehicle-to-Everything (C-V2X), which enables communication between vehicles, infrastructure and other road users, including vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communications. Since vehicles produced today will be used for more than a decade, integrating 5G ensures they remain compatible with emerging technologies throughout their lifespan.

The growth in the number of global cellular IoT connections not only marks the rapid development of IoT technology, but also reflects the depth and breadth of global digital transformation. 5G and LTE Cat 1 bis, as key technology drivers, are driving innovation and expansion of IoT applications, bringing new opportunities and value to global businesses and consumers.

Looking ahead, IoT Analytics analysts are optimistic about the development of 5G RedCap, proposing that 2025 will mark the first commercialization of 5G RedCap connections. It is expected that 5G eRedCap, which reaches Cat-1 level, will be released in 3GPP Release 18, while improving equipment efficiency and cost-effectiveness, promoting a smooth transition to the next generation of connections, and supporting a wide range of IoT applications, including use cases that require medium speeds, such as wearable devices and smart cameras.

This paper is from Ulink Media, Shenzhen, China, the organizer of IOTE EXPO (IoT Expo in China)