In recent years, with the rapid development of e-commerce, e-commerce platforms have gradually become one of the important sales channels for monitoring and security products, and their attention has also increased year by year. For example, the security monitoring products of manufacturers such as Hikvision, Dahua, Xiaomi, Huawei, Qiaoan, and TP-LINK have all occupied a place on online e-commerce platforms.

At present, monitoring and security products are increasingly "preferring" online e-commerce channels, and their importance is becoming greater and greater. Based on this, on the afternoon of July 24, Visual IoT, Tmall, and Interlink jointly held the "IOTE Visual IoT Ecosystem Exchange Meeting (Third Phase)".

This event specially invited Huilie, a visual IoT consultant and head of Tmall surveillance and security, to share the theme of "Opportunities and Risks of the Surveillance and Security Industry in 2024 from the Perspective of E-commerce". Starting from the sales of surveillance and security products during the 618 promotion in 2024, the development trend of e-commerce channels in the surveillance and security industry was discussed, so that industry professionals can have a clearer understanding of the market trend of the surveillance and security industry, thereby promoting the deep integration and development of the industry and its application.

According to Huilie, during the 618 promotion this year (May 20-June 20), the online sales of the IPC industry showed a development trend of "larger scale, higher penetration, and faster growth rate in the whole domain". The shipment volume of IPC on the entire network e-commerce platform was about 5 million units, and the online penetration rate reached 30%, and each e-commerce platform basically maintained double-digit growth. Among them, Taobao demand continued to grow, Tmall price band resumed to rise, and supply and user activity continued to rise.

According to the data from Tmall, due to the strong disruption of cross-border brands, the acceleration of "activation" of traditional brands, the iteration of industrial technology and the deep digging of scene expansion, the current monitoring and security industry supply chain is in oversupply, and the consumption of smart devices has recovered. Based on this, the monitoring and security industry has entered the "atypical" low-concentration oligopoly stage from the low-concentration competition stage. Among them, the leading brands have entered the full competition stage, which is turbulent and fierce; the industry is still in the stage of decentralized competition, with unprecedented pressure and unprecedented activity!

From the perspective of product trends, IPC showed the following trends during the Tmall 618 promotion: First, indoor transaction performance has picked up, and a large number of outdoor players have entered the market; second, binocular/multi-eye products have matured, and this year brands have joined the second half of the competition; third, 400W&500W pixels occupy more than half of the market share, and 800W pixels have exceeded 10%; fourth, functions are gradually converging, and there are more and more scene players; fifth, 4G/5G products maintain rapid and stable growth, and low-power series represented by solar energy/batteries quickly integrate into different scenarios, increasing the industry's customer orders; sixth, the segmented tracks of care and black light are still in the further cultivation stage.

It is worth mentioning that for the first time in three years, the price trend of cameras has reversed. Huilie said that the core driving factors of this phenomenon are mainly due to the rapid outbreak of outdoor products represented by solar energy on the industry side, the upgrade of basic parameters represented by 500W & 800W; the accelerated layout of high-end customer orders on the brand side has driven the premium, and the adjustment of platform traffic strategy has affected it.

In short, the industry has entered an era of stock competition: attracting new users outside the domain is imminent; high-net-worth products and user activity have increased, and the industry's brand premium ability has increased; the industry's vitality is unprecedented, but the competitiveness has not increased significantly, and the user coverage ability in the sinking market has weakened. In this regard, Mr. Huilie said, "With the trend track clear, it is becoming increasingly difficult for the monitoring product industry to win at the starting line. The blue ocean is quickly turning into a red ocean. Players are competing on quality and service long-term effectiveness, capital and supply chain endurance."

At present, facing the development trend of field fragmentation, "eliminating the false and retaining the true" of traffic, and supply centralization, players in the monitoring and security industry not only face the pressure of rising e-commerce operating costs, but also face the challenge of testing the full-domain operating capabilities of large merchants and testing technology research and development and trend insight capabilities.

"You must bend down to pick up sesame seeds, and you must have the ability to tell stories, so that you can increase the quantity without increasing the price." Mr. Huilie said that in this context, the most important thing for monitoring and security manufacturers is to get closer to users and technology. Not everyone has to compete on price, but to focus on resources to penetrate. While achieving technology inclusiveness, we must also focus on the real needs of consumers.

Afterwards, Dr. Zhu Caizhi, founder of Interlink, also introduced the company's business. Interlink is a Shenzhen-based specialized AI company focusing on visual AI innovation. It has independently developed algorithms for multiple scenarios such as pan-parks, gas stations, security and firefighting, business halls, mining areas, and home security, as well as end-side and edge-side intelligent software and hardware and light delivery scenario solutions.

Since its establishment, the company has positioned itself as "seeing clearly" + "understanding" to innovate and empower the development of the industry. Among them, in the field of "seeing clearly", the company provides a full range of solutions for SDK, chips, and modules; in the field of "understanding", the company has a variety of general and industry algorithm research and development capabilities, forming a self-selected boutique visual AI algorithm market, providing users with AI+industry algorithm products and solutions. Finally, Zhu Bo also introduced a series of products such as Yeying · Ultra-low light full-color camera, Lingyao · High-altitude throwing intelligent monitoring camera, Huoyan · Intelligent fire detection camera, Zhihe · Artificial intelligence all-in-one machine, etc.

Finally, each guest introduced the development profile and main business of their respective companies in turn, strengthened mutual understanding and laid a good foundation for subsequent cooperation; at the same time, in-depth exchanges and discussions were carried out on issues such as the current status of the industry, pain points and difficulties.

This paper is from Ulink Media, Shenzhen, China, the organizer of IOTE EXPO (IoT Expo in China)

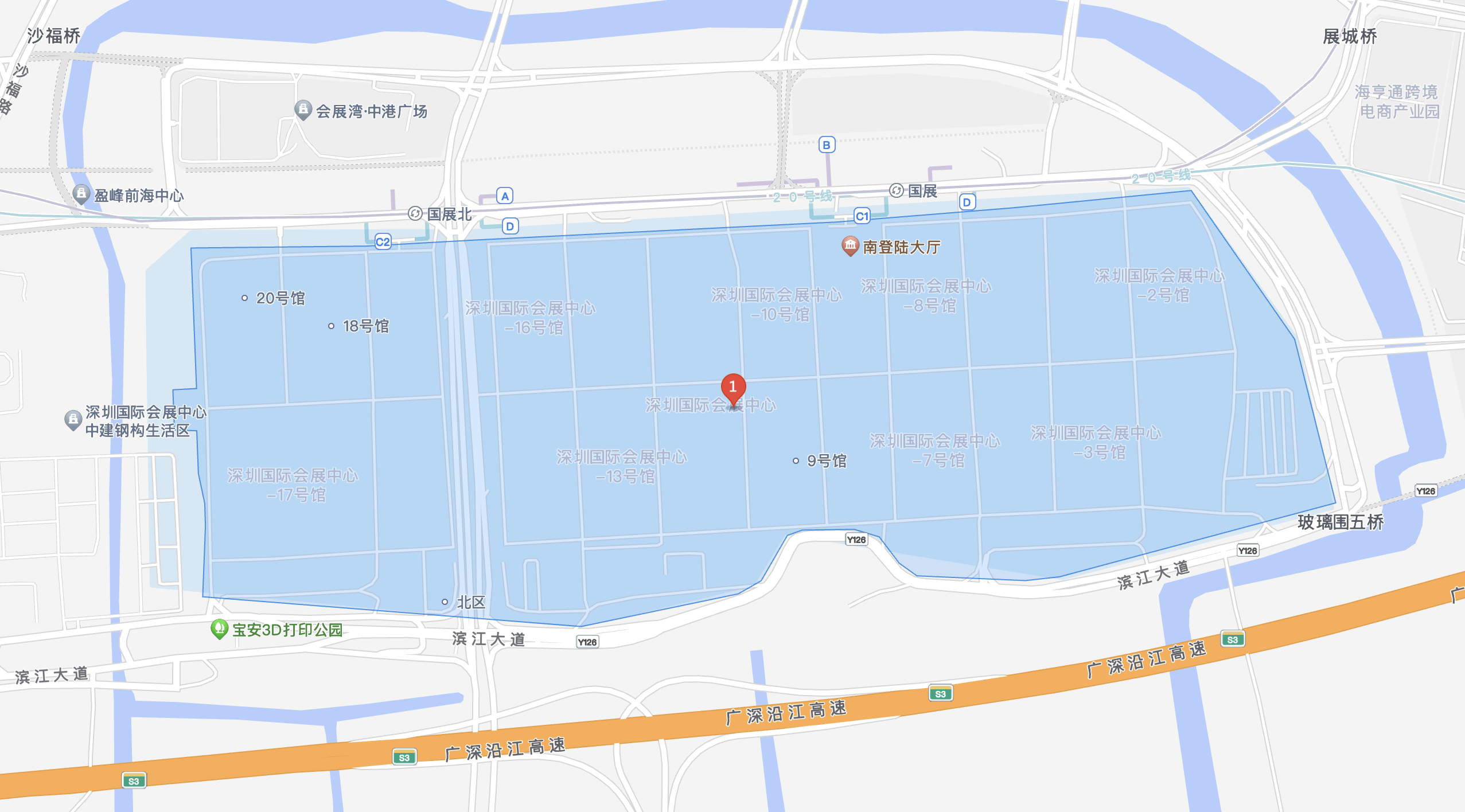

Join us at August 28–30 in Shenzhen, and let’s shape the future of technology together!

To register IOTE 2024 Shenzhen station:

https://eng.iotexpo.com.cn/sz/Visitors.html?lang=EN&source=YJ1