Recently, Counterpoint Research released several global cellular IoT module-related industry reports, including the global cellular IoT module market analysis in Q2 2024 and the global cellular IoT module & AI cellular module market forecast in 2030.

After sorting out by the intelligent communication positioning circle, the core points of the report are as follows:

China leads the global cellular IoT market

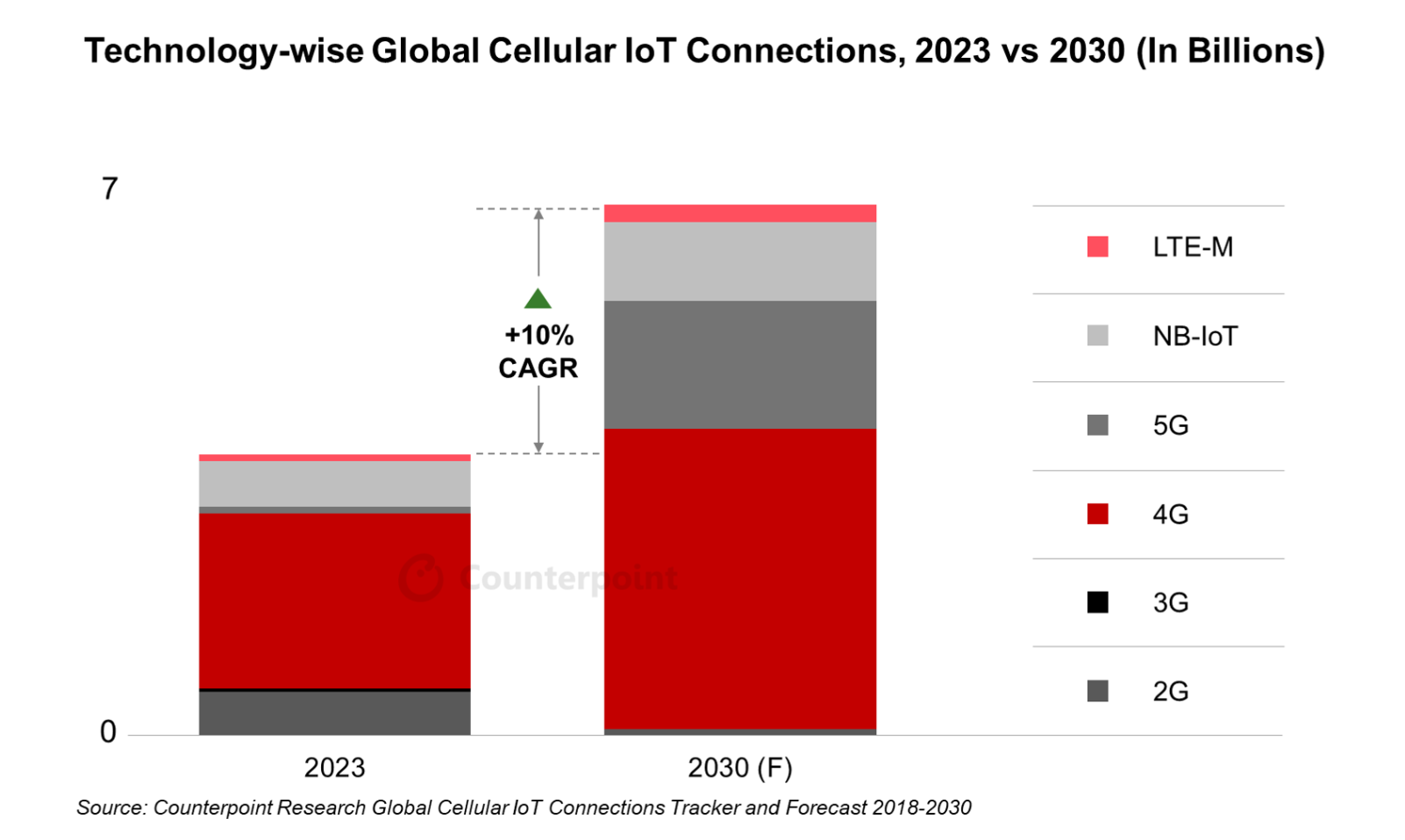

Counterpoint's latest IoT connection tracking shows that despite the challenges in the cellular IoT module field, the number of global cellular IoT connections in 2023 still achieved a year-on-year growth of 24% to 3.3 billion. It is expected that by 2030, the number of connections will exceed 6.2 billion, with a compound annual growth rate of 10%. Although ARPU (average revenue per connection) continues to decline, global cellular IoT connection revenue still increased by 17% year-on-year to US$13.7 billion.

Image source: Counterpoint Research

Counterpoint predicts that by 2030, global cellular IoT revenue will exceed $26 billion, and as ARPU stabilizes, revenue growth will be driven mainly by continued growth in the number of connections.

Among them, China leads the global cellular IoT market with an absolute advantage, with more than 2.3 billion network connections in 2023, accounting for nearly 70% of the global total, a year-on-year increase of 26%.

With the active layout of mobile network operators, the number of cellular IoT connections in China has even surpassed the number of mobile phone users. However, despite the large number of connections, China only accounts for 36% of global cellular IoT revenue, indicating that China's ARPU is relatively low.

Mohit Agrawal, research director of Counterpoint, pointed out that currently, a considerable number of devices in China still rely on 2G and NB-IoT network connections, with an ARPU of less than $2.2 per year. With the popularization of 5G technology and the promotion of 4G Cat-1 bis solutions, China is expected to expand network connections to more areas such as automobiles, smart meters and smart retail, and this shift will stabilize the ARPU value.

China achieved strong growth of 25%, and Q2 dominated the global top five

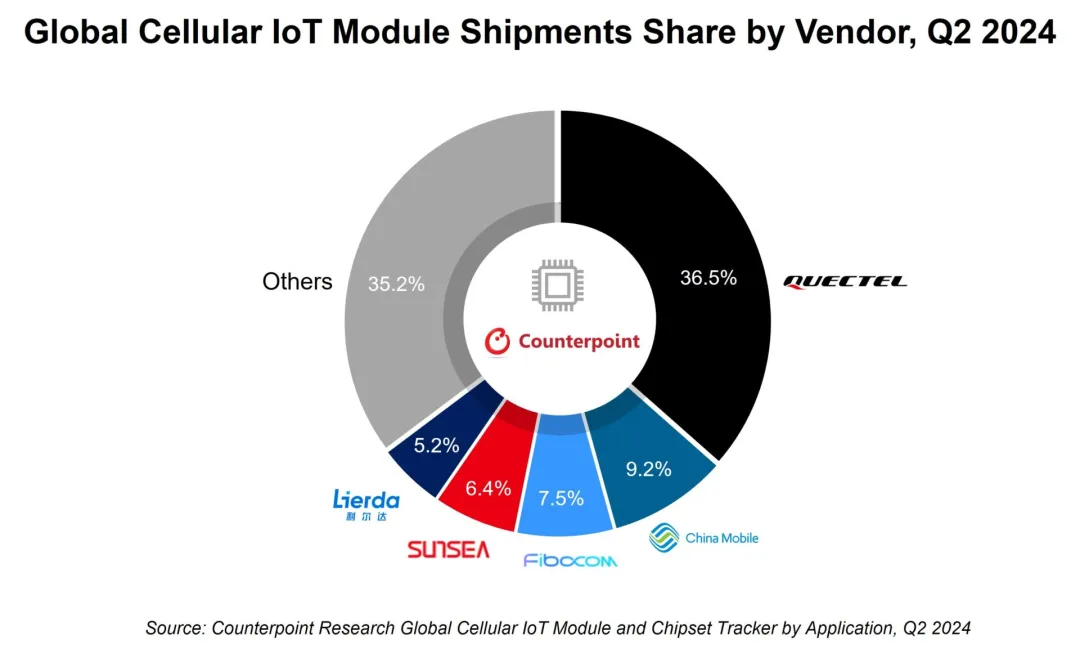

According to Counterpoint's latest "Global Cellular IoT Module and Chipset Tracking Report by Application", in the second quarter of 2024, global cellular IoT module shipments increased by 11% year-on-year and 6% month-on-month. Thanks to the surge in demand for speakers, automobiles and asset tracking applications, shipments in the Chinese market increased by 25% year-on-year.

Among them, as the fastest-growing market segment, 4G Cat 1 bis maintained its strong momentum, accounting for 42% of the market in the second quarter, and its contribution to global shipments doubled from a year ago. The average selling price (ASP) has almost halved in the past year, making it more cost-effective in smart meter and speaker applications.

In terms of market share, the previous article "The latest cellular module TOP5, Lierda is on the list for the first time, China Mobile rushed to the second place, and the boss position is very stable" by Smart Communication Positioning Circle has reported that Quectel Communications continues to lead the market, China Mobile replaced Fibocom in second place, and Fibocom fell to third place. Together, these three companies account for more than half of the global market share in the second quarter of 2024. With its strong performance in Cat 1 bis applications, Lierda entered the global top five for the first time.

Image source: Counterpoint Research

In the module chipset market, Qualcomm continues to lead, followed by ASRock and Unisoc. ASRock nearly doubled its market share with its strong performance in 4G Cat 1 bis chipsets, accounting for nearly half of the market share in this field in Q2 2024.

Research analyst Subhadip Roy said: "Chipset vendors such as Qualcomm, A-Link, Unisoc, MediaTek and HiSilicon have launched 5G RedCap chipsets. While the early adoption of these chipsets is taking place in China, US operators are also actively preparing. The launch price of 5G RedCap modules is about twice that of 4G Cat 4 modules, so people will pay close attention to how pricing evolves to support the adoption of 5G RedCap technology."

5G connections will account for nearly 50% of total IoT connection revenue

The Ministry of Industry and Information Technology released the latest data: as of the end of August, the total number of 5G base stations in my country reached 4.042 million, accounting for 32.1% of the total number of mobile base stations, and 5G mobile phone users reached 966 million, accounting for 54.3% of mobile phone users.

Due to the urgent need for large bandwidth and low latency for high-demand applications such as self-driving cars, industrial automation and immersive smart cities, Counterpoint expects that by 2030, 5G will surpass NB-IoT connections worldwide and account for nearly 50% of global cellular IoT revenue.

Research analyst Siddhant Cally believes that as 2G and 3G technologies are gradually eliminated by the market, businesses can take advantage of the huge potential of massive machine type communications (mMTC) provided by 5G to drive revenue growth based on network connections.

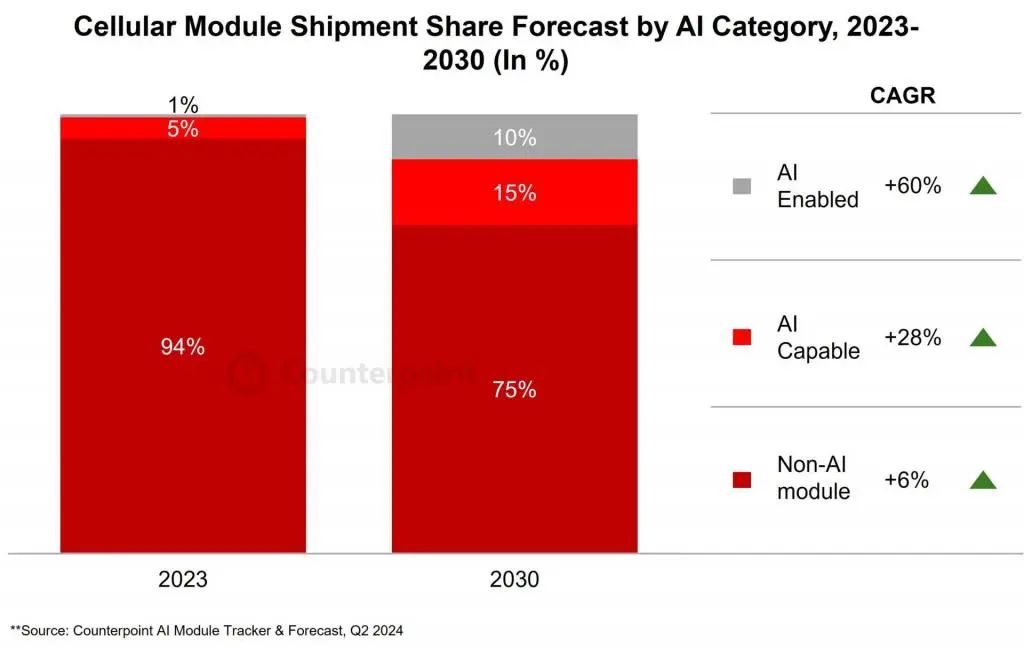

AI embedded cellular modules will account for 25% of IoT module shipments

Looking to the future, AI embedded cellular IoT modules will become an important driving force for market growth. Such modules can use embedded computing resources to perform advanced data analysis and even artificial intelligence reasoning directly on IoT devices.

According to Counterpoint statistics, the market share of AI embedded cellular modules in 2023 was 6%, but it is experiencing explosive growth, with an estimated annual compound growth rate of 35%. By 2030, AI embedded cellular modules will account for 25% of IoT module shipments.

Image source: Counterpoint Research

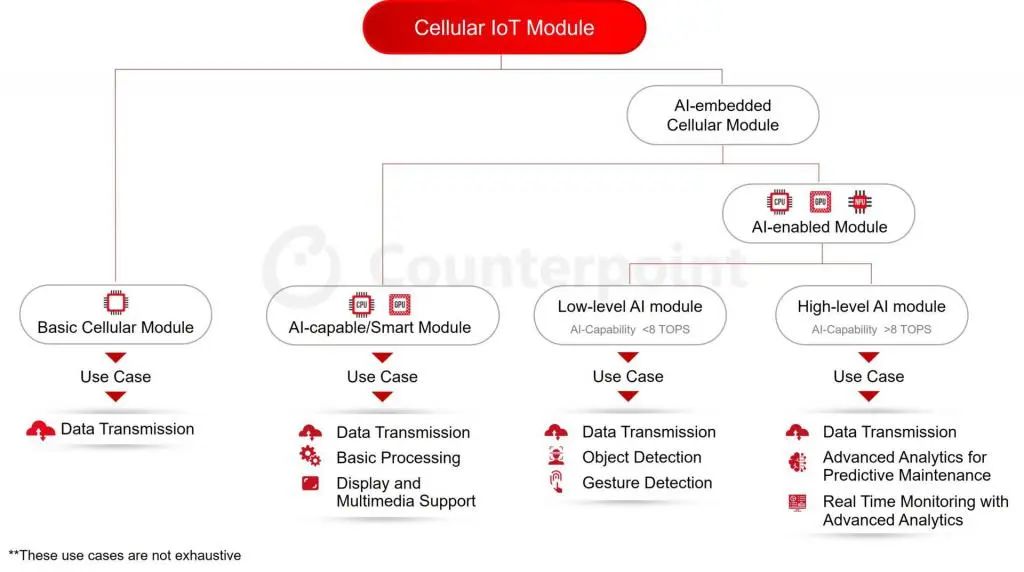

In the report, Counterpoint divides AI embedded cellular modules into three categories: basic cellular modules, cellular modules with AI functions, and AI cellular modules, which are defined as follows:

Basic cellular modules: only include baseband or chipset, mainly providing connections for IoT devices to send and receive data.

Cellular modules with AI functions: equipped with CPU, GPU and connection baseband, mainly focusing on connection and basic data processing.

AI cellular modules: integrate advanced processors such as CPU, GPU, neural processing unit (NPU) or Tensor processing unit (TPU), or dedicated AI engines to enhance artificial intelligence functions.

Image source: Counterpoint Research

Counterpoint also divides AI cellular modules into the following two categories:

Entry-level AI cellular modules: provide medium AI functions, usually perform AI reasoning at a speed below 8TOPS.

Advanced AI cellular modules: support AI reasoning above 8TOPS and can handle more complex tasks.

According to the intelligent communication positioning circle, domestic leading manufacturers have accelerated the layout of AI cellular modules, such as the AI smart module product SG368Z series launched by Quectel Communications, the high-computing AI module product line of MeiG Smart, and the 5G AI smart module SC171 released by Fibocom.

Three major applications will occupy half of the market

Counterpoint Research pointed out that the Internet of Vehicles, smart meters and smart retail will continue to dominate the development of the cellular Internet of Things field. By the end of 2030, these three applications will account for more than 60% of the cellular Internet of Things market.

Not only that, the application of AI embedded cellular modules in these fields will become more and more prominent:

The Internet of Vehicles is improving the automation and safety of vehicles. With the popularization of digital cockpits, the application of AI embedded cellular modules is also growing rapidly. AI-driven virtual assistants can respond to voice commands, manage navigation, and control in-vehicle entertainment systems, significantly improving the driving experience.

Smart meters will optimize energy use and utility management and improve utility management efficiency. In the future, routers equipped with artificial intelligence can serve as central hubs for managing smart home devices such as lights, thermostats and security systems, enabling more efficient home automation management.

Smart retail is using data-driven insights to improve safety. More and more smart displays are equipped with AI embedded cellular modules at the point of sale and in retail systems. With the advancement of AI technologies such as face recognition and gesture recognition, both entry-level and advanced AI cellular modules will be integrated into the system to help analyze customer behavior, manage inventory and detect fraud.

In addition, AI embedded cellular modules will also be used in drones, rugged handheld devices, robots, digital signage, security cameras and other fields. According to Counterpoint Research, by 2030, the automotive and POS industries will become the main driving force for the growth of AI embedded cellular module shipments.

Smart Internet Industry Chain Review

The Ministry of Industry and Information Technology recently issued the "Notice on Promoting the Development of "Intelligent Connection of Everything" in the Mobile Internet of Things", aiming to improve the supply level, innovation empowerment capabilities and overall value of the mobile Internet of Things industry, and accelerate the development of the mobile Internet of Things from "Internet of Everything" to "Intelligent Connection of Everything".

At present, many manufacturers in the industry chain have laid out a new ecosystem for the intelligent connection industry. The relevant manufacturers are summarized as follows:

Baseband chips

Qualcomm, MediaTek, Unisoc, Huawei HiSilicon, Intel, Aojie Technology, Yixin Communication, Core Wing Information, Zhilian Security, etc.

Communication modules

Quectel Communications, China Mobile IoT, Meige Intelligent, Fibocom, Sunsea Intelligent, Lierda, Youfang Technology, Gosuncn, Jiulian Technology, etc.

Edge computing gateways

Beiliande, Zhiwei Intelligent, Yanxiong, Huawei, Yinghantong, Sanwang Communication, Four-Faith, UIoT, Zhuolan, Hongdian, etc.

This paper is from Ulink Media, Shenzhen, China, the organizer of IOTE EXPO (IoT Expo in China)