Today, OmniVision Group's latest OV0TA1B monochrome/infrared CMOS image sensor has been released.

It is reported that the sensor is suitable for 3mm module Y size, as well as small notebook computers, webcams and IoT devices.

Samples have been launched

Mass production is expected in Q1 2025

It is reported that OV0TA1B samples are now available and are expected to be mass-produced in the first quarter of 2025.

This low-power component is the preferred solution for artificial intelligence (AI)-driven human presence detection (HPD), face recognition and always-on (AON) technology.

The OV0TA1B sensor has both infrared and monochrome usage modes, which can be selected on demand (assuming there is another independent RGB camera in the system). Its 2-micron pixel design based on PureCel® pixel technology not only has excellent sensitivity and modulation transfer function (MTF) performance, but also can efficiently support HPD and face recognition functions.

The OV0TA1B sensor can capture images with a resolution of 440x360 at a rate of 30 frames per second. It uses a 1/15.8-inch optical format, consumes 2.58mW (at 3fps), and measures 220x180.

It is understood that the company is the earliest and largest manufacturer to enter the application of CMOS sensors in camera phones.

When camera phones were first used in 2003, CCD technology was all Japanese suppliers, and CMOS technology was mainly European and American manufacturers. Among them, Omnivision's products are the most influential. One-third of the world's mobile phone cameras use Omnivision.

From 1998 to the end of 2004, Omnivision shipped a total of 190 million CMOS image sensor components, of which 92 million were shipped in 2004 alone. Products are sold all over the world. Almost all mobile phone factories and design companies in mainland China are Omnivision's customers.

In recent years, Omnivision has launched a number of highly anticipated sensor products, such as OV48C, OV64B and flagship sensor OV50H, which have been adopted by many smartphone manufacturers for the main camera of high-end flagship models, further consolidating Omnivision's leading position in the CMOS image sensor market.

In addition, Omnivision actively cooperates with domestic and foreign companies to jointly promote the development and application of CMOS image sensor technology. Its strong technical strength and market influence make Omnivision the third in the global CMOS chip market, second only to Sony and Samsung.

The CIS market is highly monopolized

The top three companies have a combined market share of over 70%

The market for CMOS image sensors (CIS) has shown a steady growth trend in recent years. According to data from the China Commercial Industry Research Institute, the global CMOS image sensor market will reach US$25.313 billion in 2023, and is forecast to grow to US$27.327 billion in 2024. This growth has been driven by several factors, including technological innovation, expansion of application areas, and increased consumer demand for high-quality imaging technology.

From the perspective of competition landscape, the CMOS image sensor market is a highly monopolized market, with the top three companies’ combined market share exceeding 70%. Sony, Samsung and Chinese company OmniVision Technology dominate the market. Sony occupies a leading position in the market with its high-quality products and technological innovation, while Samsung follows closely behind with its strong manufacturing capabilities and brand influence. Howe Technology has achieved significant shares in the Chinese and global markets through continuous technology research and development and market expansion.

In terms of application fields, CMOS image sensors are widely used in smartphones, security monitoring, automotive electronics, medical imaging and other fields. As the smartphone market becomes saturated and competition intensifies, CIS manufacturers begin to focus on other high-value markets, such as automotive electronics and medical imaging. These fields require higher performance and quality of CIS, but at the same time they also provide greater profit margins for CIS manufacturers.

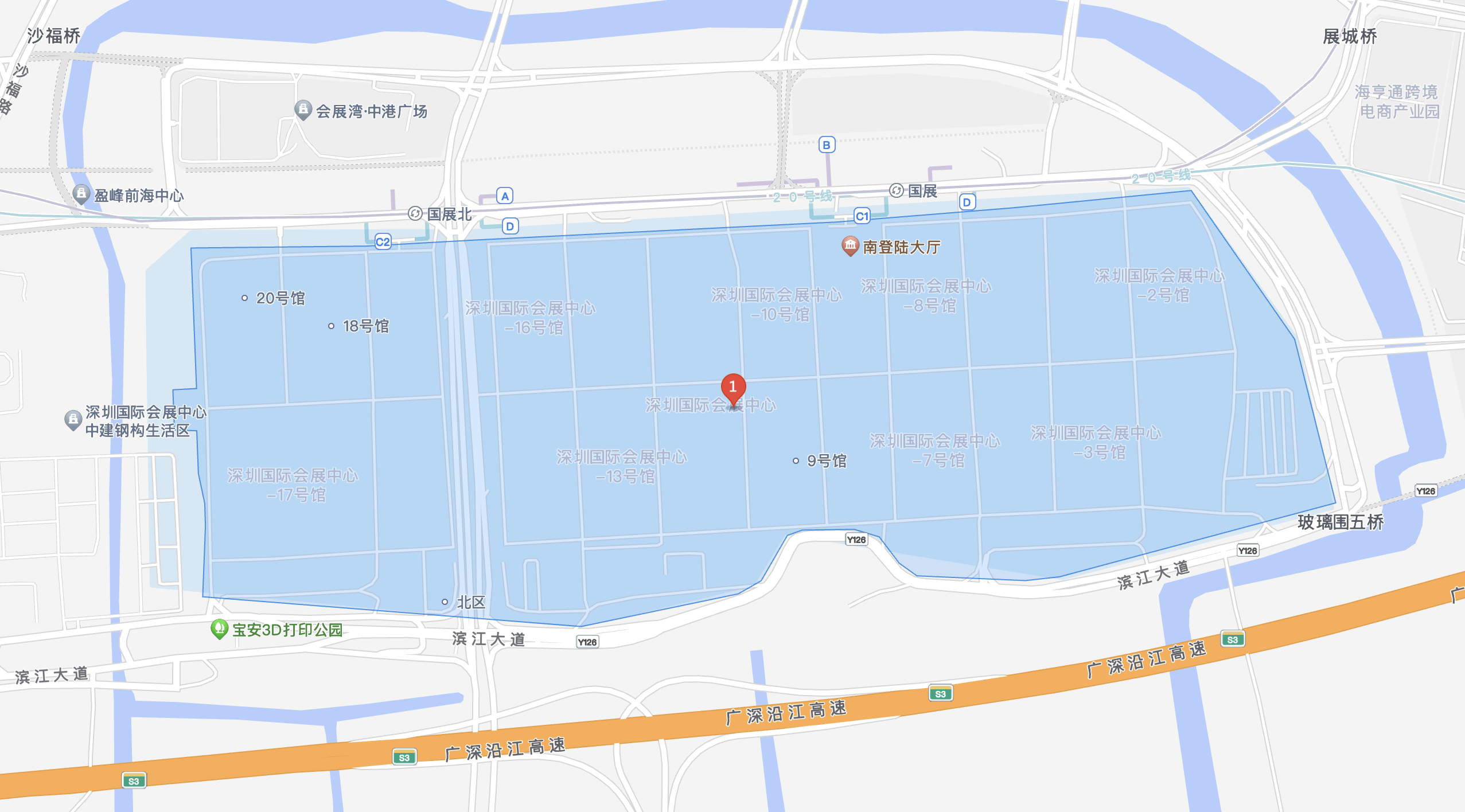

This paper is from Ulink Media, Shenzhen, China, the organizer of IOTE EXPO (IoT Expo in China)