On July 27, RAYTRON released a performance announcement stating that the company's finance department has completed the preliminary accounting work for the first half of 2024, and it is expected that the cumulative operating income in the first half of 2024 will be approximately RMB 2.02 billion, a year-on-year increase of 13%; the net profit attributable to the parent company will be approximately RMB 220 million, a year-on-year decrease of 13%. In the first half of 2024, new orders were approximately RMB 218 million, a year-on-year increase of 30%. As of June 30, 2024, the company had approximately RMB 106 million in orders on hand.

RAYTRON was established in 2009. Since its listing on the Science and Technology Innovation Board in 2019, RAYTRON's performance has continued to grow. In 2023, the company achieved a net profit attributable to the parent company of RMB 500 million, a year-on-year increase of 59.58%.

As a national high-tech enterprise engaged in the design and manufacturing technology development of application-specific integrated circuits, special chips and MEMS sensors, RAYTRON provides global customers with excellent performance MEMS chips, ASIC processor chips, infrared thermal imaging and temperature measurement full industry chain products, lasers, microwave products and optoelectronic systems, forming a pattern of infrared business as the main business, microwave, laser and other multi-dimensional perception coexisting.

Since 2024, RAYTRON has continued to increase its R&D investment and new product development efforts, actively explore the market, and promote domestic and foreign market promotion work in an orderly manner. New orders are positive, and R&D and production delivery are progressing smoothly. Sales revenue continued to grow rapidly in the first half of 2024.

Previously, due to the impact of US sanctions, RAYTRON's delayed delivery of some orders in May and June affected the growth of sales revenue in the second quarter, and normal delivery has now resumed; in addition, based on the principle of prudence in accounting, the company has set aside about 100 million yuan in bad debt reserves, which has a certain impact on the net profit in the first half of the year.

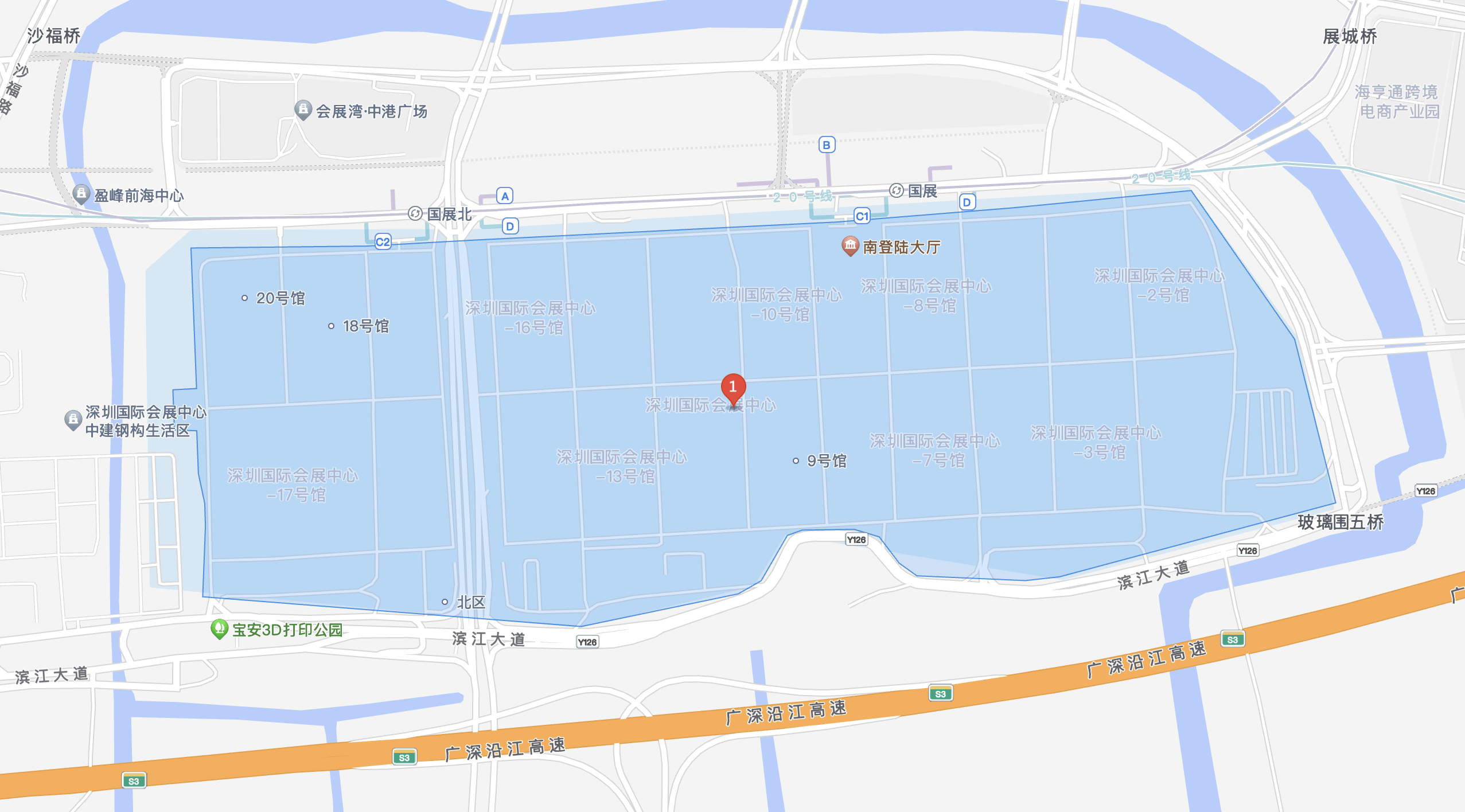

This paper is from Ulink Media, Shenzhen, China, the organizer of IOTE EXPO (IoT Expo in China)

Join us at August 28–30 in Shenzhen, and let’s shape the future of technology together!

To register IOTE 2024 Shenzhen station:

https://eng.iotexpo.com.cn/sz/Visitors.html?lang=EN&source=YJ1