The research on the new version of “2024 China RFID Passive Internet of Things Industry White Paper” is in progress. The companies that have participated in the research so far are:

Shenzhen Guoxin IoT Technology Co., Ltd.

Checkpoint Trading (Shanghai) Co., Ltd.

Sensormatic (Shanghai) Technology Co., Ltd.

Shanghai Fudan Microelectronics Group Co., Ltd.

Zhihuixinlian Microelectronics Co., Ltd.

STMicroelectronics

Wuxi Qilian Electronic Technology Co., Ltd.

Shanghai Kunrui Electronic Technology Co., Ltd.

Jiangsu Anzhibo Electronic Technology Co., Ltd.

Shenzhen Bowei Intelligent Identification Technology Co., Ltd.

Xingyan Technology (Hangzhou) Co., Ltd.

Pingtouge Semiconductor Co., Ltd.

Hangzhou Meister Intelligent Technology Co., Ltd.

Shenzhen Sigan IoT Technology Co., Ltd.

Weijian International Trading (Shanghai) Co., Ltd.

Shenzhen Mingqi Smart Card Technology Co., Ltd.

Sichuan Kailuwei Technology Co., Ltd.

Shenzhen Uboxun Technology Co., Ltd.

More companies in the RFID passive IoT industry are welcome to participate in our survey.

In the RFID industry (even in all walks of life), companies are faced with a choice: Do they want to ship more? Or profit margin?

A wise friend might say: Children only make choices, and adults always want everything. Of course, if you can have both, it must be the most perfect solution, but the reality is that many times you cannot have both.

Why is it difficult to have both?

Do you want shipment volume or profit margin? For an enterprise, there are two different business paths:

Shipment volume: The main indicator pursued by enterprises is volume. When the shipment volume is large, the natural market size will increase, and the market share will be greater.

The characteristics of a large-volume market include: high degree of standardization, large customers or high customer concentration. This is conducive to the rapid expansion of enterprises, and accordingly, it is also easy to involute.

Want profit margin: The company pursues a profitable market. In such a market, due to factors such as relatively small competition, severe customization, and more after-sales operation and maintenance services, the overall price and profit will perform better. But again, such markets are generally relatively stable and difficult to expand in scale.

For an industry, in the early stages, due to small shipments and high marginal costs, products generally maintain a high gross profit level in order to maintain the company’s R&D and operating costs. As the industry grows and matures, product shipments will increase 10 times or even a hundred times, and the cost and price of the corresponding products will also decrease a lot (the specific reduction will vary greatly depending on the industry), but generally speaking, The market size of the industry will increase as shipments increase.

However, under some specific conditions, a phenomenon will occur: shipments increase, but revenue scale does not.

This phenomenon is not uncommon in some market segments of the current RFID industry.

To give a simple example, in a certain segmented scenario, the annual shipment volume of UHF RFID readers was 1,000 units/year 10 years ago, and the unit price 10 years ago was 1W yuan, then the market capacity was 10 million/year. Year. After 10 years of development in the industry, shipments have grown to 10,000 units/year, but the price of UHF RFID readers has also dropped to a unit price of more than 1,000 yuan. The total market output value may only grow slightly, not much.

Although shipments have increased, overall revenue has not increased much. Although costs have also dropped, it is obvious that the company’s profit margin has also dropped a lot.

Therefore, companies often need to make a choice: choose a market with shipments or a market with stable profits?

Because no matter which path you take, the survival, development and growth of the enterprise are the common goals.

Next, let’s discuss in detail how to analyze the shipment market and gross profit rate market in the RFID field.

What are the markets with shipments?

Based on the current market status, we have sorted out the markets with a relatively large number of RFID tags on the market.

Because RFID tags are cheap, our screening conditions for markets with relatively large carding volume are: the total volume is more than 5 billion PCS, and the volume of a single customer is more than several hundred million.

In addition to the markets listed above with a volume of more than 5 billion PCS, there are many markets with a volume of several hundred million PCS or more, such as books and archives, food & medicine, airline luggage, etc.

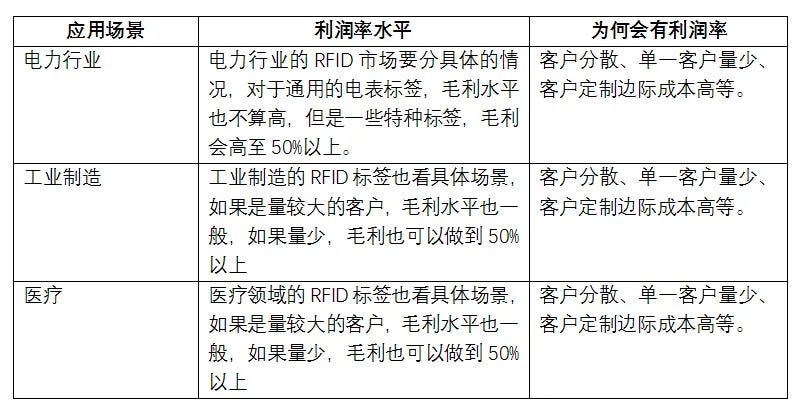

What are the markets with profit margins?

Of course, the markets with high profit margins are far more than the categories we have listed. There are also many subdivisions such as campus, municipal management, casino chips, animal management, and the national military standard market.

In fact, under the current situation of information transparency and industrial involution, it is difficult for us to find a market that is 100% guaranteed to have high profit margins, because this is a false proposition. Its logic is that if a certain industry The gross profit is very high, and the market is still relatively large, so such a market will definitely attract many players to enter, thus lowering the gross profit of the industry.

Therefore, we can only look at such a market on a case-by-case basis.

According to our understanding of the industry, in order to form a high-margin market, in addition to the conditions listed in the above table such as dispersed customers, small number of single customers, and high marginal costs of customer customization, some human intervention factors also need to be added: for example Market entry qualification threshold (a small number of players are admitted, so it is not so complicated), and poor market information (secretly making a fortune).

Finally, in summary, there is no distinction between the above two business paths. It depends on the company’s own goals and choices.

During this “2024 China RFID Passive Internet of Things Industry White Paper”, through communication with friends in the industry, I felt a consensus in the industry: reasonable profits can better protect the development of the industry.

Regarding this topic, we will analyze it separately in future articles. Interested comments are welcome to interact.

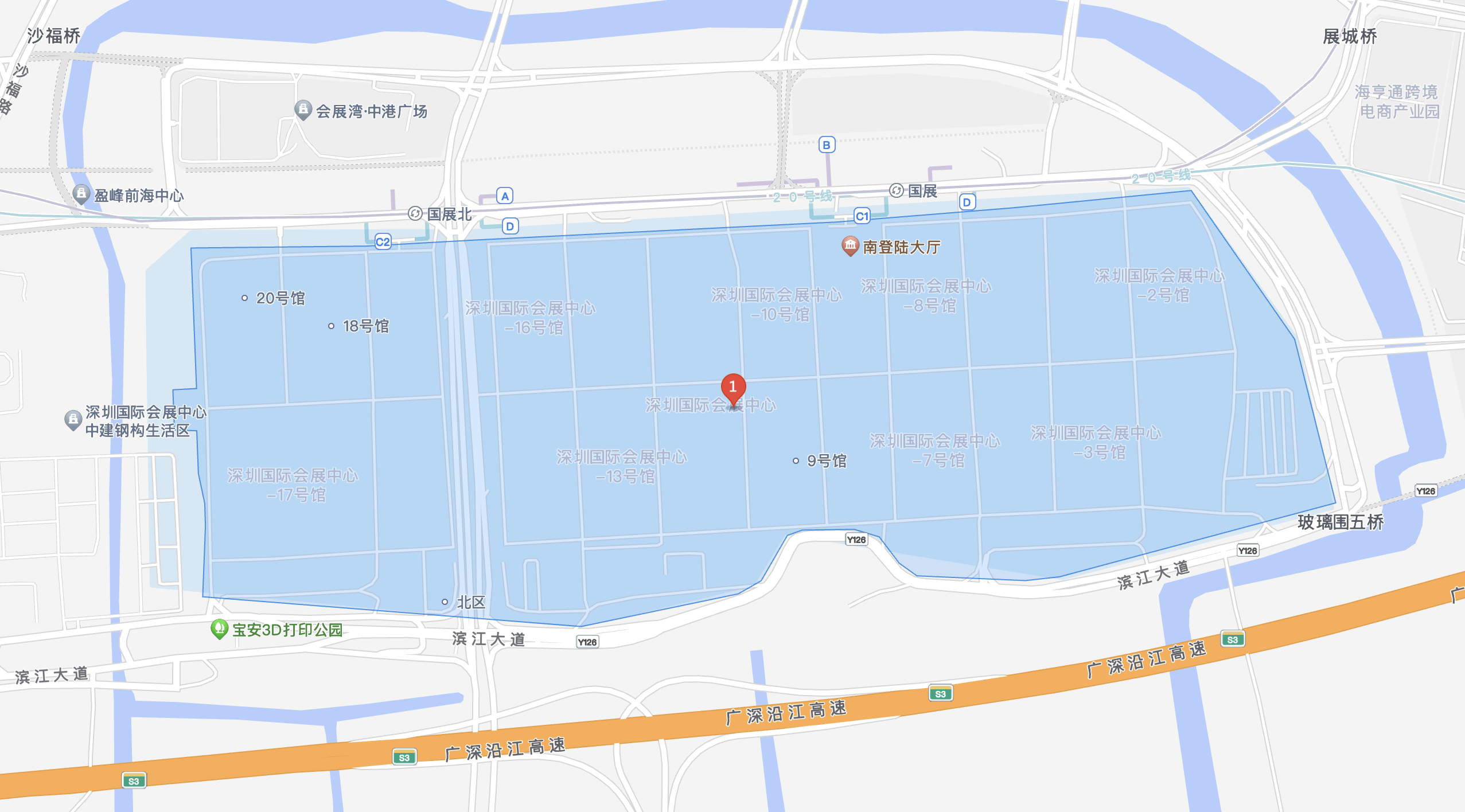

This paper is from Ulink Media, Shenzhen, China, the organizer of IOTE EXPO (IoT Expo in China)

Join us at August 28–30 in Shenzhen, and let’s shape the future of technology together!

To register IOTE 2024 Shenzhen station: https://eng.iotexpo.com.cn/sz/Visitors.html?lang=EN&source=YJ1