In recent years, the trajectory of Ultra-Wideband (UWB) technology has mirrored the success stories of Apple and digital car keys in the mobile market. Whether it’s NIO’s innovative NIOphone or collaborations between automakers and smartphone giants, UWB has taken center stage. As the in-car ecosystem continues to evolve, UWB integration is on the verge of becoming a standard technology.

Simultaneously, after two years of solidifying its presence in the consumer © market, UWB has started exploring possibilities beyond smartphones and automobiles.

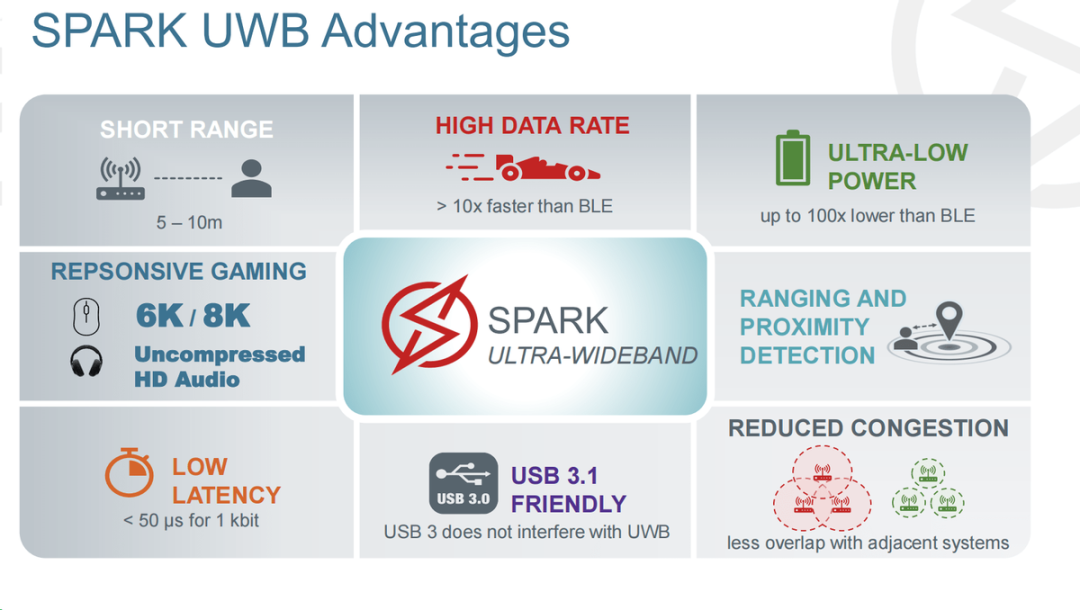

Recently, the renowned Italian manufacturer Sonus Faber introduced Duetto, the industry’s first UWB-powered consumer audio device. The Duetto speaker system boasts diverse audio sources, including optical fiber, HDMI, and RCA/turntables. With Wi-Fi and Bluetooth connectivity, it streams content from smartphones and other devices, supporting major streaming services and protocols. The standout feature is UWB technology from SPARK Microsystems.

Can UWB Succeed in Wireless Audio?

Beyond SPARK’s optimism for UWB headphone adoption, industry players like PSB Speakers, MQA, and Sonic are planning to launch the world’s first set of wireless headphones using Ultra-Wideband (UWB) technology instead of Bluetooth in the first quarter of 2024.

Currently, Bluetooth serves as the standard technology for wireless portable audio. Widely used in mainstream wireless audio products such as Airpods and FreeBuds Pro, Bluetooth’s bandwidth limitations leave ample room for improvement in audio transmission and quality. This creates market opportunities for UWB.

Compared to Bluetooth, UWB has a limited range (approximately 10 feet to up to 100 feet) but offers substantial bandwidth. This provides headphones with up to 24-bit/192kHz or higher quality lossless high-resolution audio. This is a rare technological advantage for wireless audio products in the market, typically priced at a premium but delivering mediocre sound quality.

Additionally, as a low-power wireless technology, UWB’s integration implies a significant extension of battery life, meeting consumers’ demands for prolonged usage.

Addressing the signal-blocking issue, SPARK plans to equip its headphones with Antennaware’s UWB antenna, making UWB more suitable for wireless wearable devices.

From an ecosystem perspective, any UWB headphones require compatibility with smartphones or other devices equipped with built-in UWB radios. Currently, UWB technology is widely adopted in Apple’s product line, with support on all iPhone models from iPhone 11 onwards. Other major manufacturers like Samsung, Xiaomi, Meizu, OPPO, Google, and more are actively following suit with models such as Samsung Galaxy S21 Plus, Ultra series, Google Pixel 6 Pro and 7 Pro, Meizu 20 Pro, etc. As UWB gains traction in the smartphone market, UWB wireless audio products will quickly integrate into this growing ecosystem.

In summary, with the development of urbanization and supercity structures, the increasing length of daily commuting times activates the “ear economy,” rekindling the demand for cutting-edge wireless headphones. The superior technology of UWB may open new growth avenues for itself and the wireless audio market.

Expectations for the C-end Market of UWB

Previously, the UWB Alliance conducted a market forecast for the future of UWB, predicting that by 2025, over a billion devices supporting UWB technology will be produced globally. This includes 80% of smartphones and related accessories and 11% of in-car access devices equipped with UWB technology.

In practice, UWB’s strategy for the consumer © market is clear, centered around smartphones and extending to more smart hardware to meet the diverse needs of consumers for an enhanced experience.

In addition to soon-to-be-launched wireless audio products, UWB C-end applications that have already landed include specific hardware products such as tags and robotic vacuum cleaners. Solution-based products like Xiaomi’s “One-Finger Connect” and Huawei’s “Lingxi One-Finger” are also gaining ground in the UWB consumer application landscape.

Simultaneously, with technological advancements and application recommendations, the UWB ecosystem is growing stronger. From chips, antennas, and UWB RTSL solutions to automobiles and mobile devices, leading manufacturers are actively entering various segments of the industry chain. It can be said that in the future, UWB technology will continue to heat up in the C-end market, unleashing even greater potential.

This article was originally published by Ulink Media, the organizer of IOTE EXPO (IoT Expo in China).

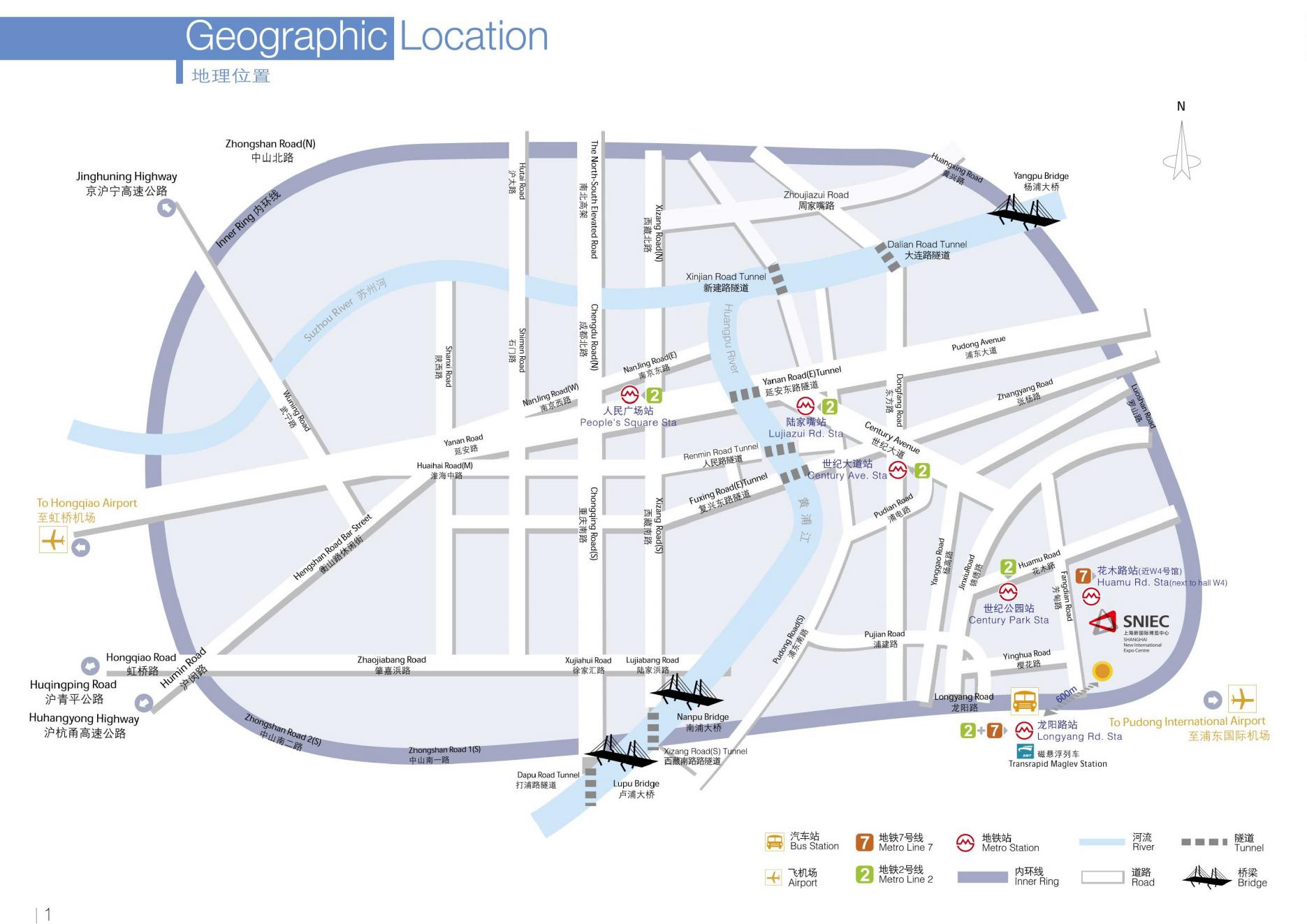

Join us next year in Shanghai, and let’s shape the future of technology together!

To register IOTE 2024 Shanghai station: