Undoubtedly, digitization stands as one of the primary themes driving contemporary societal advancement. Presently, various industries can undergo digital transformations, marking a significant shift towards industrial upgrading.

The very name “digitization” underscores the centrality of “data,” with spatial location data emerging as a fundamental dimension within the realm of positioning technology industry development.

However, delving into the positioning industry reveals a multitude of techniques, each with its own set of advantages and limitations. Particularly in today’s market environment, integrated positioning solutions are gradually becoming mainstream, whether in consumer products at the C-end or industry applications at the B-end. Therefore, excelling in the positioning industry necessitates a comprehensive understanding and awareness of various positioning technologies in the market.

First Dimension: From the perspective of whether infrastructure investment is required for positioning, it can be divided into two categories: those requiring infrastructure and point-to-point positioning ranging.

This article consolidates and summarizes mainstream positioning technologies in the market.

UWB (Ultra-Wideband) Technology

Technology Overview:

UWB (Ultra-Wideband) is a carrier-free communication technology that utilizes nanosecond to microsecond non-sinusoidal narrow pulse transmission of data. In 2002, the Federal Communications Commission (FCC) in the United States officially opened the 3.1 GHz to 10.6 GHz frequency band for indoor communication purposes using UWB, marking the commencement of UWB’s utilization in civilian wireless communications. In China, in early 2023, the Ministry of Industry and Information Technology’s Radio Management Bureau issued the “Ultra-Wideband (UWB) Equipment Radio Management Regulations (Draft for Solicitation of Comments),” under which the future domestic UWB technology usage frequency band is set at 7235–8750MHz.

UWB possesses three major capabilities:

Communication: With features such as large data transmission, reaching several hundred Mbit/s, and transmission distances of up to hundreds of meters, although transmission capability significantly attenuates over longer distances, it offers high security. For conventional communication systems, UWB signals are akin to white noise signals, making them challenging for other devices to intercept.

Radar: As a radar technology source, UWB possesses high spatial resolution, enabling strong target identification capabilities, suitable for short-range radar, vehicle vital sign detection, etc.

High-Precision Positioning: Serving as a high-precision positioning technology, UWB boasts high accuracy, with positioning precision reaching the centimeter level, nearly unmatched in the market in terms of positioning accuracy using radio frequency signals. Additionally, it offers large capacity compared to other wireless positioning technologies and low latency, among other characteristics.

UWB positioning algorithms fall into three categories:

Time of Arrival (ToA) or Time of Flight (ToF): ToA determines the position by measuring the propagation time of signals between the mobile terminal and three or more base stations, employing circular positioning.

Time Difference of Arrival (TDoA): TDoA is based on time difference of arrival for positioning, requiring precise time synchronization functionality within the system. Time synchronization comes in two forms: wired synchronization, which achieves synchronization within 0.1ns, offering high precision but increasing network maintenance complexity and construction costs due to wired deployment, and dedicated wired time synchronizers, which are comparatively expensive.

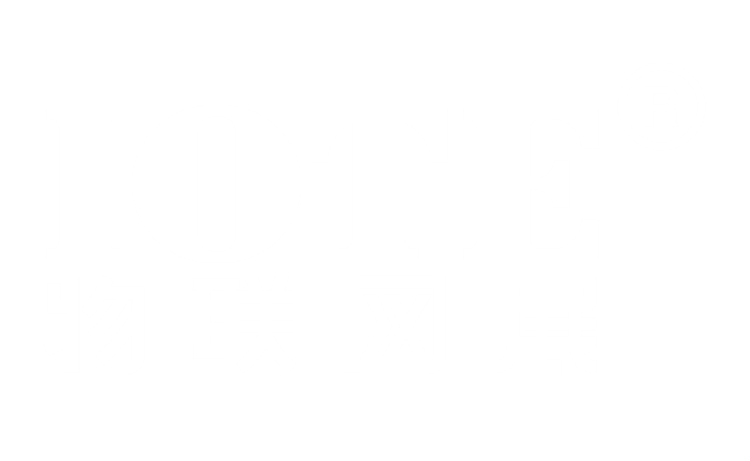

Angle of Arrival (AoA): AoA positioning typically calculates the arrival angle based on phase difference. It is generally not used alone, as AoA involves angle resolution issues, resulting in decreased positioning accuracy as the distance from the base station increases.

Market Overview:

Currently, UWB positioning technology is flourishing across various sectors, categorized into four main markets:

IoT Enterprise Applications: Including chemical plants, power plants, coal mines, public security, warehousing logistics, etc.

IoT Consumer Applications: Encompassing various smart hardware embedded with UWB chips, such as TV remote controls, pet collars, item trackers, smart robots, etc.

Automotive Market: Typical products include digital car keys, etc.

Mobile Phone Market: Incorporating UWB chips into mobile phones.

BLE (Bluetooth Low Energy) Positioning Technology

BLE positioning technology involves using BLE as a signal source to achieve positioning functionality. It can be classified into four categories based on its positioning methods.

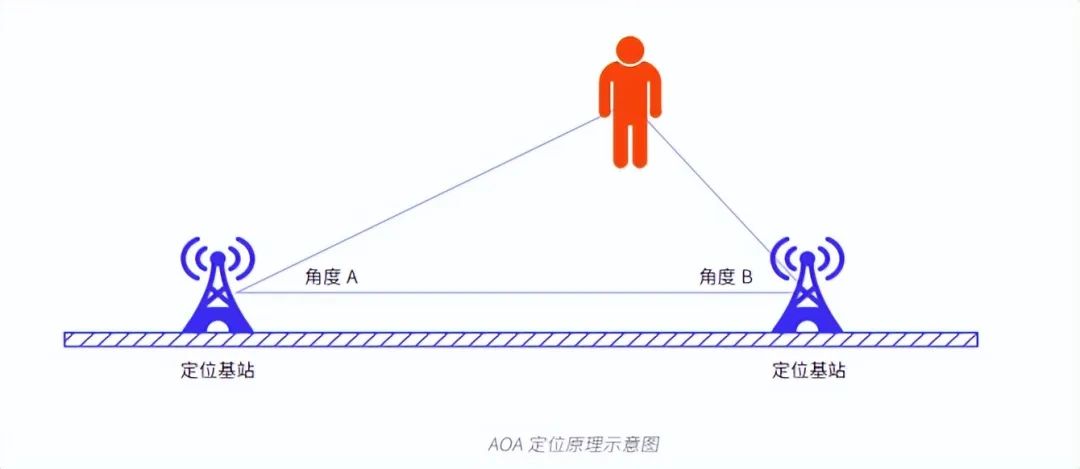

Bluetooth AoA/AoD Positioning: The Bluetooth 5.1 standard introduced AoA and AoD angle positioning algorithms, achieving sub-meter-level (within 1m) positioning accuracy.

Bluetooth Beacon Positioning: Based on Received Signal Strength Indication (RSSI) for positioning, Bluetooth Beacon utilizes trilateration for more accurate position information, with accuracy ranging from 1–3m.

Consumer Point-to-Point Positioning Products: Referring to products centered around smartphones, not requiring positioning networks but only connections with the product to be positioned.

Bluetooth Gateway Room-Level Positioning: Utilizing Bluetooth gateways combined with RSSI to achieve room-level positioning, suitable for asset management scenarios.

5G Positioning Technology

5G positioning employs 5G signals to achieve positioning functionality, aiming to leverage existing 5G infrastructure without additional network deployment costs, thus augmenting precise positioning capabilities (sub-meter-level accuracy) atop high-performance connectivity.

From the perspective of 5G positioning principles, positioning technologies can be roughly categorized into three types: triangulation and computation-based positioning, scene analysis-based positioning, and proximity-based positioning.

Sound Wave Positioning Technology Analysis

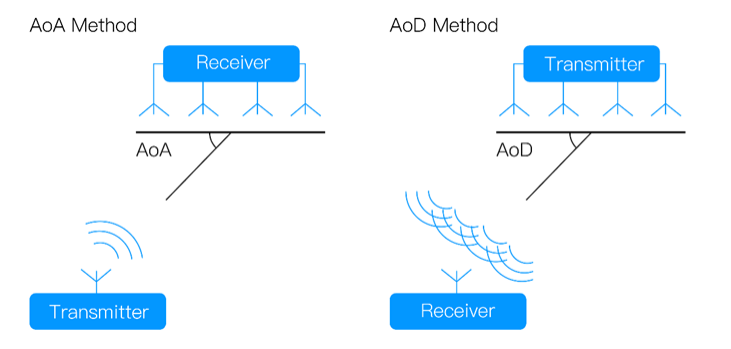

Sound wave-based indoor positioning technology, characterized by low cost, high accuracy, and good compatibility, is particularly suitable for consumer-grade smartphone indoor positioning scenarios. Utilizing built-in smartphone microphones eliminates the need for additional devices.

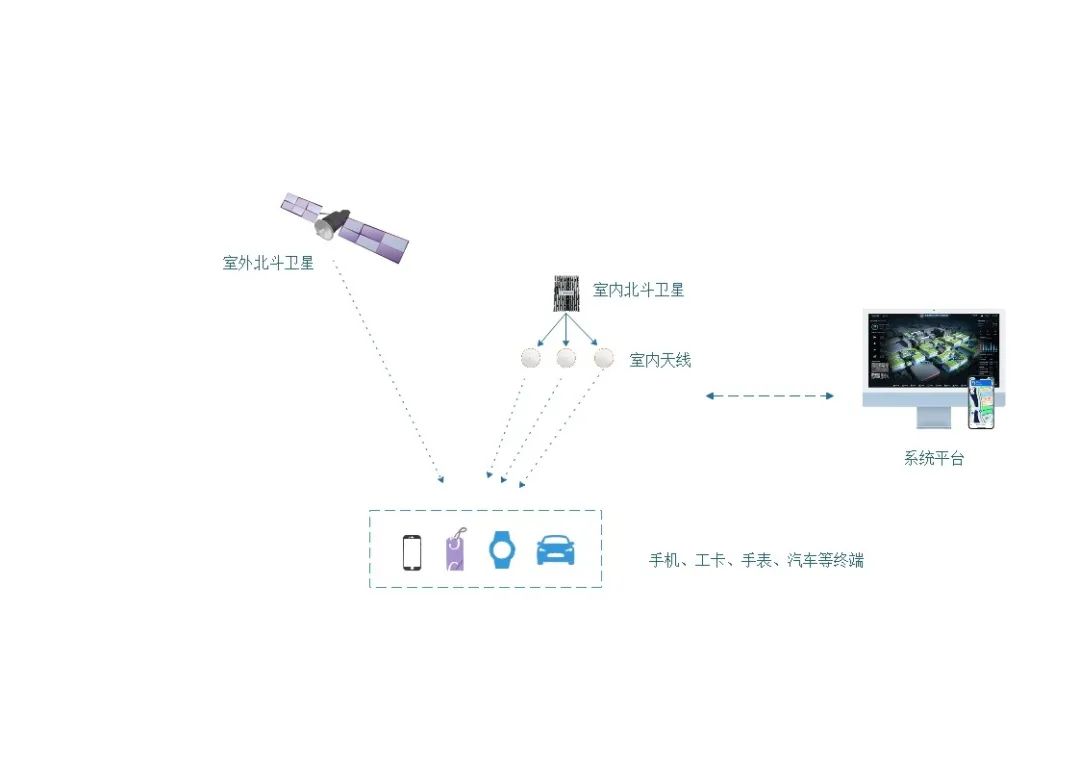

Indoor BeiDou Positioning Technology Analysis

Indoor BeiDou, as the name suggests, refers to BeiDou satellite positioning technology in indoor obstructed environments. While GNSS positioning systems are robust, they suffer from signal loss due to obstructions, necessitating the emergence of indoor BeiDou positioning technology.

Magnetic Field Technology Analysis

The Earth’s magnetic field, varying across different regions due to geological factors, offers a unique means of positioning, particularly suitable for various moving carriers in different environments, including indoors.

Wi-Fi Positioning Technology Analysis

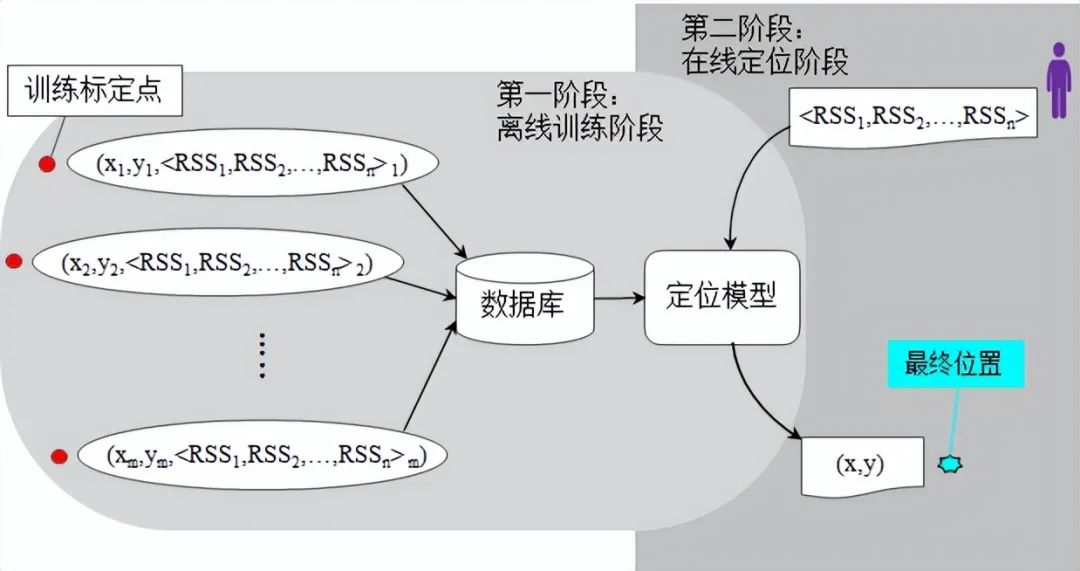

Wi-Fi fingerprinting-based positioning establishes a mapping relationship between difficult-to-measure location information and easily measurable Wi-Fi signals, relying on two fundamental assumptions: the correlation between Wi-Fi signal fingerprints and geographic locations, and the relationship between Wi-Fi fingerprint matching and distance between different sampling points.

Each of these positioning technologies presents unique advantages and challenges, catering to diverse application scenarios across industries. Understanding their intricacies is crucial for leveraging their potential in various contexts.

This paper is from Ulink Media, Shenzhen, China, the organizer of IOTE EXPO (IoT Expo in China)

Join us next year in Shanghai, and let’s shape the future of technology together!

To register IOTE 2024 Shanghai station:

https://eng.iotexpo.com.cn/sh/Visitors.html?lang=EN&source=YJ1